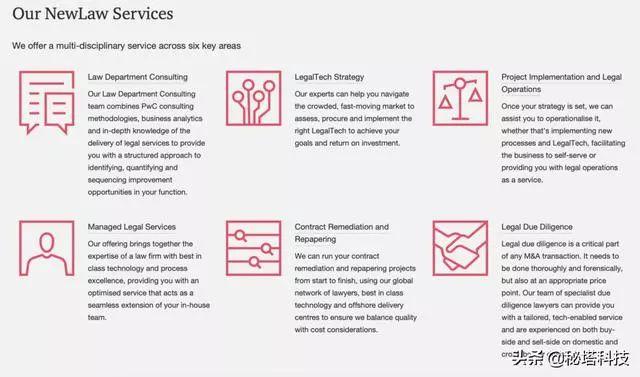

“我們正在為法律行業的設計和運作模式提供幫助。

“We are helping with the design and operating model for legal departments.”

版權聲明:所有瑞恩資本Ryanben Capital的原創文章,轉載須聯繫授權,並在文首/文末註明來源、作者、微信ID,否則瑞恩資本Ryanben Capital將向其追究法律責任。部分文章推送時未能與原作者或公眾號平台取得聯繫。若涉及版權問題,敬請原作者聯繫我們。

更多香港IPO上市資訊可供搜索、查閱,敬請瀏覽:www.ryanbencapital.com

香港IPO上市申請失敗:被聯交所拒絕的24個案例匯總 (2018年)

香港IPO上市申請失敗:被聯交所拒絕的39個案例匯總(2013-2017年)